DVFA monthly question: Generational capital is generally welcomed

In the latest monthly question, DVFA Investment Professionals were asked what they think of the German government’s pension package and the “generational capital” it contains to support state pension funding. “Of course, the longest journey begins with the first step. For many investment experts, however, the discussion about funded pension provision feels about as old as this proverb by Lao Tzu,” says Roger Peeters, CEO of DVFA, describing the results of the survey. “‘Too late, too little’ was the tenor of many of the comments we received. On the other hand, the opinion clearly prevailed that the start that has finally been made is more important than the individual criticism of the concept.”

Future of the European Banking Ecosystem 2035

At a pivotal era of digital and regulatory evolution, the European banking sector anticipates significant shifts. Insightful collaboration between industry leaders and academics has led to four scenarios forecasting the industry’s transformation, highlighting digital banking, decentralized finance, and ESG regulations as key factors. This analysis offers a strategic blueprint for navigating the future.

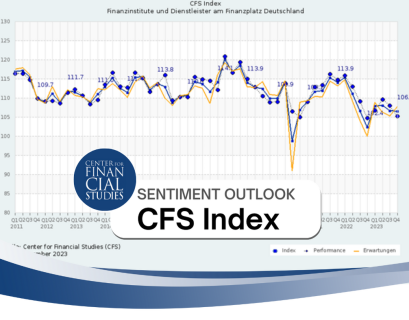

CFS Index remains stable thanks to good results in the last quarter

In the fourth quarter of 2023 at +0.8 points, the CFS Index shows almost unchanged stability in the German financial sector. Despite positive results, expectations for the first quarter of 2024 are significantly more pessimistic, particularly among service providers.

Offenbach Economic Development presents annual report 2023

Economic development in Offenbach am Main continues to make progress even in challenging times. The 2023 annual report from the city’s economic development agency shows how progress is being made at the location in concrete terms.

Not just for FinTechs – start-up scholarship from the state of Hesse

From 1 February to 1 March 2024, all start-ups in Hesse that are no more than 5 years old can apply for the scholarship push!.

Frankfurt economist Philipp Sandner passed away

The financial centre mourns the loss of Prof. Dr Philipp Sandner, an influential character in the German blockchain scene.

Bundesbank calls for networking of players in the financial centre

The financial centre Frankfurt has a special responsibility in financing the transformation of the economy. This is why Bundesbank board member Sabine Mauderer is calling for closer networking between the players.

SSM supervisory priorities 2024–2026

The European Central Bank recently published its updated supervisory priorities for the years 2024-2026. Our member KPMG has analysed what the priorities mean for banks.

3 Questions to Corinna Egerer, Founder and Managing Director of Frankfurt Digital Finance

Corinna Egerer and Max Hunzinger co-founded Frankfurt Digital Finance in 2019. Since then, the conference has developed into one of the leading events in the Frankfurt financial center and does not only have national but also international appeal. We spoke to the founder about the journey there and the upcoming conference.

Data centre boom that has been going on for years will continue to grow

Data centres are booming thanks to cloud giants such as AWS and Microsoft. FMF member BNP Paribas predicts that they will offer the greatest growth potential of any asset class in the coming years. Read more in this article.