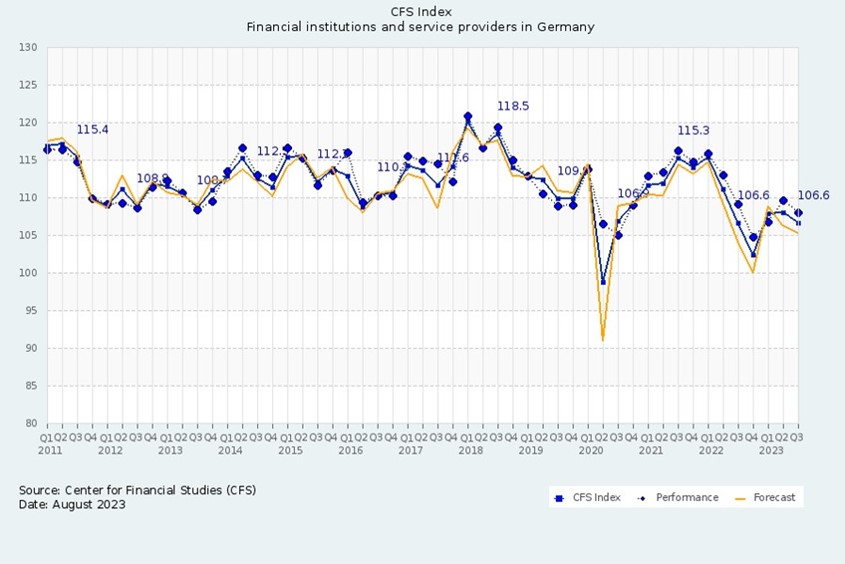

The financial institutions, on the other hand, report a positive trend across all sub-indices. In particular, their growth in revenue and earnings has increased. For the current third quarter, the expectations of the entire financial sector are somewhat more restrained. Only the service providers expect to bring the short-term job cuts of the second quarter to an end.

“The slump in the economy as a whole is increasingly affecting the financial sector; sentiment is currently worse than the actual situation,” comments Professor Rainer Klump, Director of the Center for Financial Studies.

The rating of the future international importance of the Financial Centre Germany fell significantly in the second quarter of 2023, based on the assessment of the financial institutions. With a decline of -4.9 points, the index currently stands at 96.2 points, which puts it below the neutral mark of 100 points again after a brief recovery in the previous quarter.

“This development is a wake-up call. The successes of the past, such as the high number of banks that have relocated business to the Main after Brexit or the establishment of the International Sustainability Standards Board (ISSB), offer numerous starting points for further growth. We should make more determined use of these. Frankfurt can do more,” explains Gerhard Wiesheu, President of Frankfurt Main Finance.

Contrasting sentiment: financial institutions report rising revenue and earnings growth / Sub-indices down for service providers

Revenue growth among the financial institutions increased by +4.4 points to 114.8 points in the second quarter of 2023. This represents an increase of +4.1 points compared to the previous year. By contrast, the service providers report a significant decline of -6.5 points to 109.3 points. This puts their revenue sub-index -2.5 points below the level of a year ago. For the third quarter, the expectations of the financial sector are more restrained.

The surveyed financial institutions and service providers also report contrasting data regarding earnings growth. The corresponding sub-index of the financial institutions rises by +6.2 points to 118.4 points and is now +5.8 points above the level of the previous year. The service providers’ sub-index declines by -1.4 points to 105.2 points and is -4.8 points lower than one year ago. For the current quarter, both groups are anticipating a slight decrease.

Growth in investment volume among service providers drops significantly and is now at the neutral level of 100 points

Growth of the investment volume in product and process innovations among the financial institutions sees a slight gain of +0.4 points to 104.9 points and is only -3.6 points below the previous year’s level. The service providers report a huge drop of -10.9 points to the neutral level of 100 points. This means their sub-index for investment volume is -7.5 points below the level of a year ago. Looking ahead to the current quarter, both groups expect a slight decline.

Service providers report job cuts

In line with the other sub-indices, the financial institutions also record higher growth in employee numbers. The sub-index rises by +2.4 points to 107.8 points and is clearly above the previous year’s level (+5.2 points). Conversely, the service providers report a decline, which is also consistent with the other indicators. The employee numbers sub-index falls by -3.9 points to 99.4 points, which reflects job cuts among the service providers. At -8.5 points, this sub-index is also significantly below the previous year’s level. For the current quarter, the financial institutions expect to recruit fewer employees. The service providers plan to end the job cuts of the second quarter and start hiring again.

More from the latest CFS Index:

Source: Press Release CFS, 24. August 2023

Images: CFS / Frankfurt Main Finance / Looker_Studio via stock.adobe.com