They have long since become mainstream on the international financial markets, have been an integral part of institutional portfolios for years and private investors have also been increasingly focussing on this asset class for some time, especially millennials. We are talking about green bonds. These are earmarked bonds whose proceeds benefit climate and environmental protection projects.

These can be solar or wind parks for energy generation or renaturalisation projects, for example. The scope of application is understandably broad. Europe is regarded as the pioneer of green bonds. In 2007, the European Investment Bank (EIB), the EU bank based in the Grand Duchy of Luxembourg, launched its first climate awareness bond on the market – a global triumph for this type of debt instrument followed.

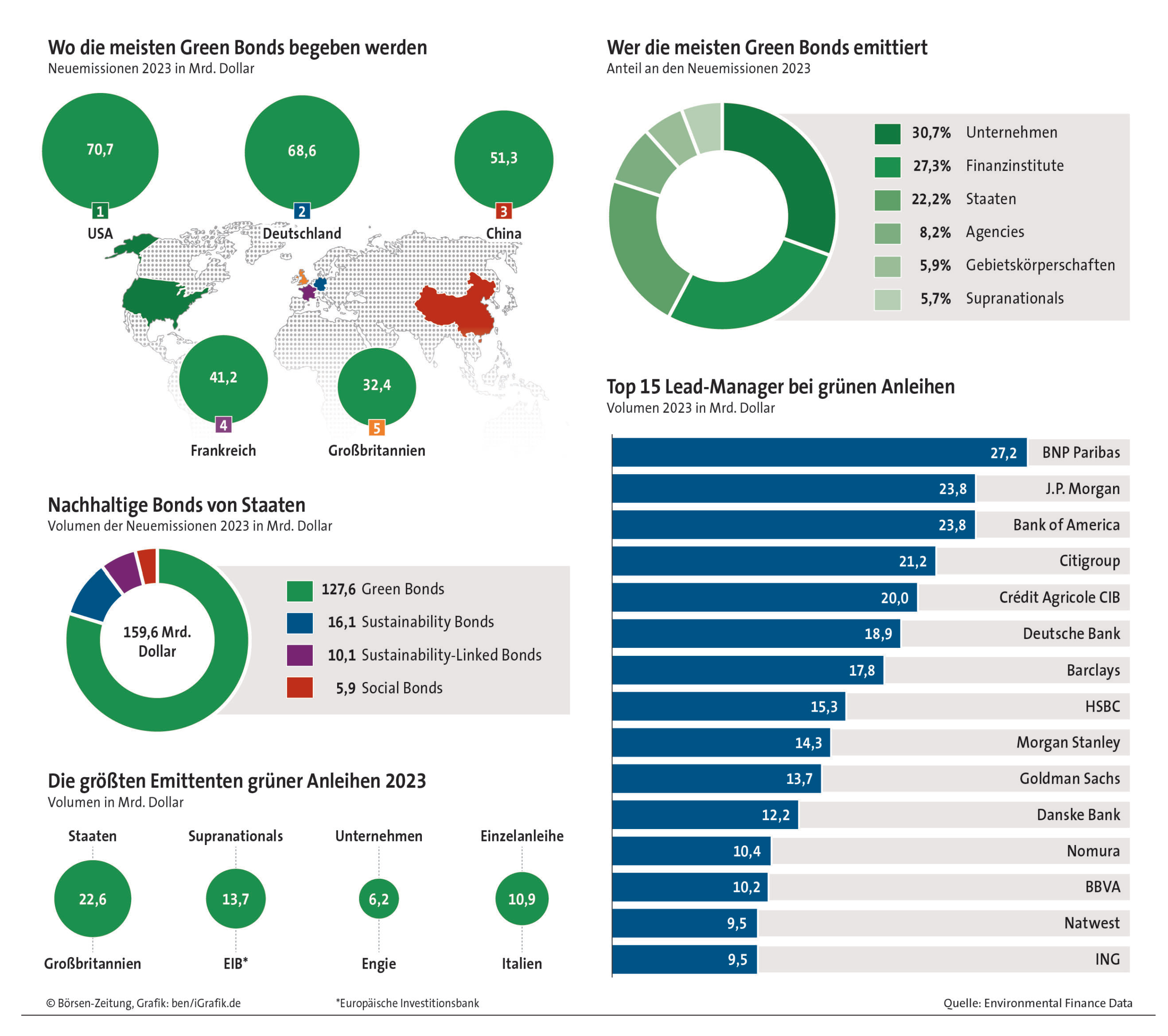

In terms of countries, US issuers dominated the green bond market last year. However, issuers from Germany, including the central government Bund, are already in second place, followed by the Chinese. Alongside financial institutions and companies, governments were among the largest issuer groups on the green bond market. Governments were able to increase their share of the market significantly compared to the previous year, while the weighting of companies declined slightly.

New issuers are also expected to enter the market in the coming years, from the ranks of states and local authorities, but also from companies and financials. This is because the issues of climate change and environmental protection are being increasingly prioritised and the need for measures in these areas is no longer disputed or even treated as a secondary priority. This should continue to be a lucrative business area for banks, as most green issues are brought to the bond market via the syndication process. There should be no shortage of supply, meaning that green bonds are likely to maintain their dominant share of the overall sustainability bond market. It stands at 80%.

Source: Börsen-Zeitung of 11 May (page 6), secondary publication right

This is an automated translation of the German original.