- Women had a 0.5 percentage point better portfolio performance than men in 2023

- Since 2019, the proportion of women aged between 25 and 34 with a portfolio has grown almost twice as fast as men of the same age

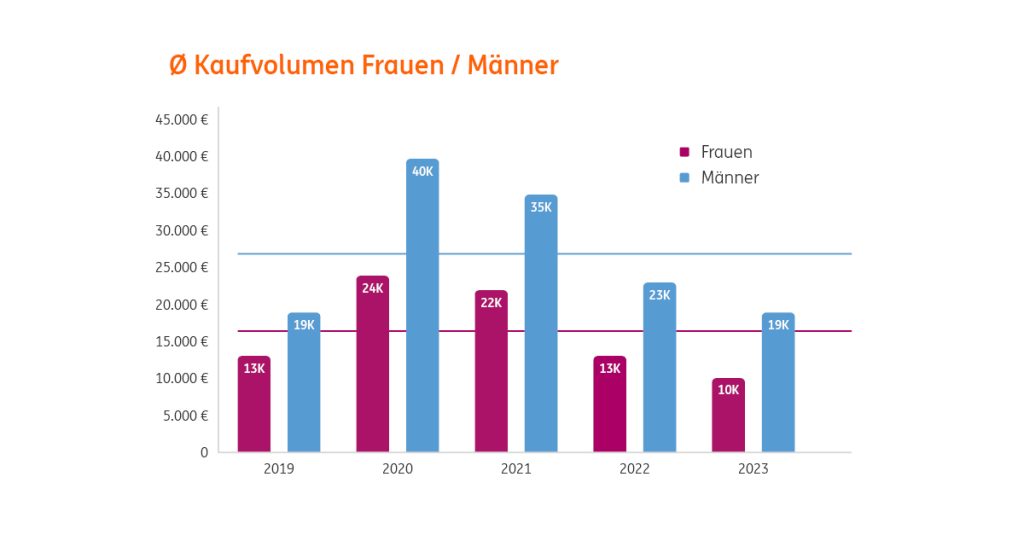

Average purchase volume of women 40 per cent lower than that of men - ETF demand has increased enormously since the coronavirus crisis – among men and women

Women prefer ETFs as an investment product and excel with better portfolio performance – these and other findings are the result of an analysis by ING Germany. For the analysis, the securities accounts of around 2.5 million customers in the period from January 2019 to December 2023 were evaluated anonymously.

Women have a better knack for investing

As early as 2019, an investor analysis by ING Germany showed that women achieve better returns in the investment sector. This picture was further confirmed in 2023. In a direct comparison, women have an average return of 15.9 per cent, 0.5 percentage points better than men at 15.4 per cent.

What is striking about the age distribution, however, is that women only perform better at an older age. Between the ages of 45 and 64, they are one percentage point ahead on average. By contrast, male portfolio holders have this percentage advantage in the younger age groups of 18 to 24 and 35 to 44.

More and more young women with custody accounts

The results also give an impression of how the investment interest of young women is developing. The development of custody accounts over the past five years shows a positive trend in the number of women with custody accounts between the ages of 25 and 34. In this age group, the proportion of female customers has risen almost twice as much (+5.4 percentage points) as male customers of this age (+2.8 percentage points).

Unequal trading volumes

Despite the increasing female interest in stock market trading, there is a significant gender difference in the level of investment. The trading volumes of women and men differ significantly. With an average purchase volume of around 16,000 euros, women invest an average of 11,000 euros less than men, who invest around 27,000 euros.

Ø purchase volume women / men

Regardless of this, a general five-year comparison shows that the trading activities of both genders increased significantly at the start of the coronavirus pandemic in 2019. Within one year, the average purchase volume rose by around 50 per cent in 2020 and thus peaked at the same time. In the following years up to 2023, however, this gradually levelled off again to pre-crisis levels.

ETF demand has risen sharply over the past five years

Looking at the percentage shares of individual products in the portfolios, there is a clear trend in the favoured products: ETFs appear to have become an increasingly popular product among the top 3 since 2019. The share of ETF volume in the average total custody account volume has almost doubled since 2023. With a share of one third, the product is still behind individual stocks as the most popular investment product. These remain in the lead with a share of 51%. However, this relative share of equities has fallen by 6 percentage points over the course of the trend. At the same time, the ETF is the only product with a strongly positive performance over the last five years. This means that the ETF could become a contender for first place among the most popular investment products in subsequent years if its performance remains similar.

Development of top 3 investment products

(share of average securities account volume)

The sharp rise in the popularity of ETFs can also be seen in the average number of savings plan executions. Last year, ETF savings plans accounted for around 70 per cent of the savings plans executed by men and women. Five years ago, these accounted for just under a third of the average number of executions per customer.

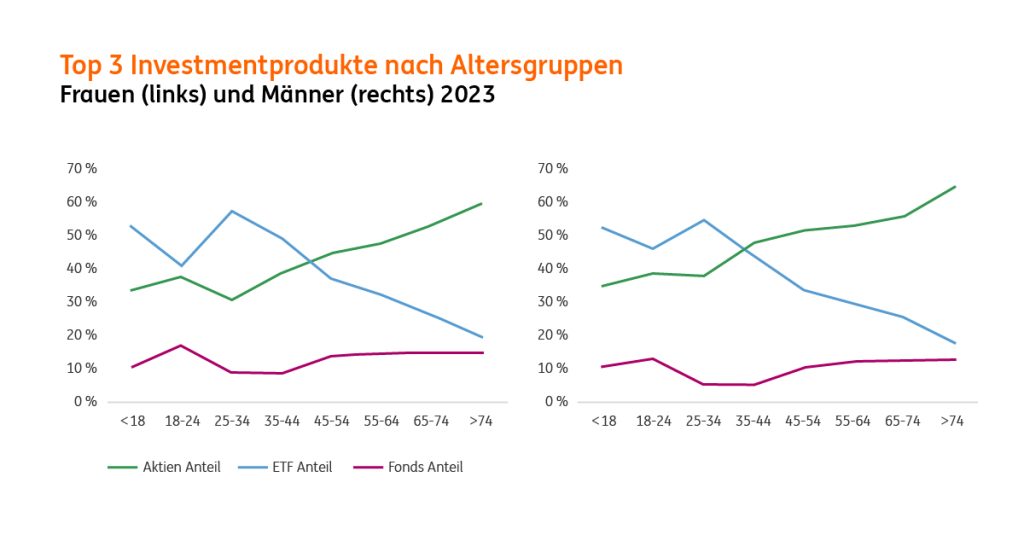

A comparison of the top 3 investment products by age shows that young people in particular have discovered ETFs as a form of investment. This difference is even clearer in a direct comparison between young and old. While older investors are increasingly focussing on equities rather than ETFs, this effect is the opposite for young portfolio holders. However, young people also frequently favour equities, whereas ETFs are found less frequently in the portfolios of older investors.

TOP 3 investment products by age group

Women (left) and men (right) 2023

Source : ING press release from 27 March 2024

Image source: ING Germany