Investors are taking the financing of the transformation of the economy into a sustainable and thus stable system in the long term very seriously: According to the BVI[1], more than 450 billion euros had already been invested in funds defined as “sustainable” by the third quarter of 2021, almost four times as much as a year earlier. A quarter of mutual fund assets is thus attributable to sustainable products. Scarcely anyone had anticipated such a rapid increase.

For the first time in many years, there is therefore an investment theme with positive connotations that is popular with clients. Selecting shares and funds on the basis of environmental and social criteria as well as good corporate governance (Environment, Social, Governance, ESG) has become the standard.

The big “but”: The regulators responsible for the financial market (EU Commission, ESMA, BaFin) have laid out a whole matrix of regulations on how sustainable asset management and funds are to be defined and what advisors must observe in connection with sustainable investment. The principal challenge here is that some of the regulatory frameworks will not fully come into force until end of 2022, or are even still being considered and amended, but advisors are already expected to communicate accordingly. In any case, it is becoming apparent that much will depend in the future on having access to accurate ESG data in order to comply with the various rules and regulations in the advisory process. With its already comprehensive integration of ESG data, Infront has laid the groundwork for this. ESG scores from Clarity AI, one of the world’s leading providers of sustainability and impact reporting, cover 30,000 companies and 20,000 funds. FMF member Infront helps clients adapt to the demand for ESG and the changing investment landscape, and meet regulatory requirements (more information).

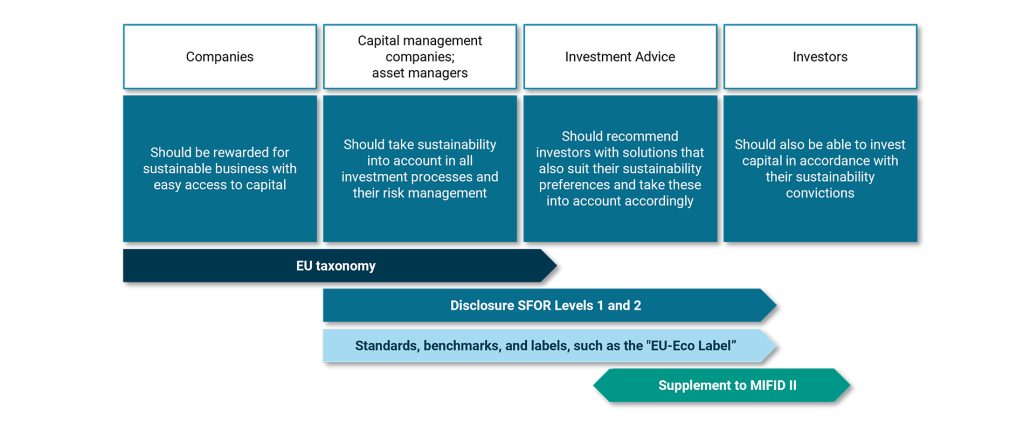

Sustainable investing is becoming the new standard of capital investment. The EU’s regulatory initiatives provide the binding guidance framework for this – an overview of the status of key developments from an investment advisory perspective. Which ESG regulations are particularly important for advisors and investors? What will change in 2022 and 2023, and how do they mesh?

EU Sustainable Financial Disclosure Regulation (SFDR)

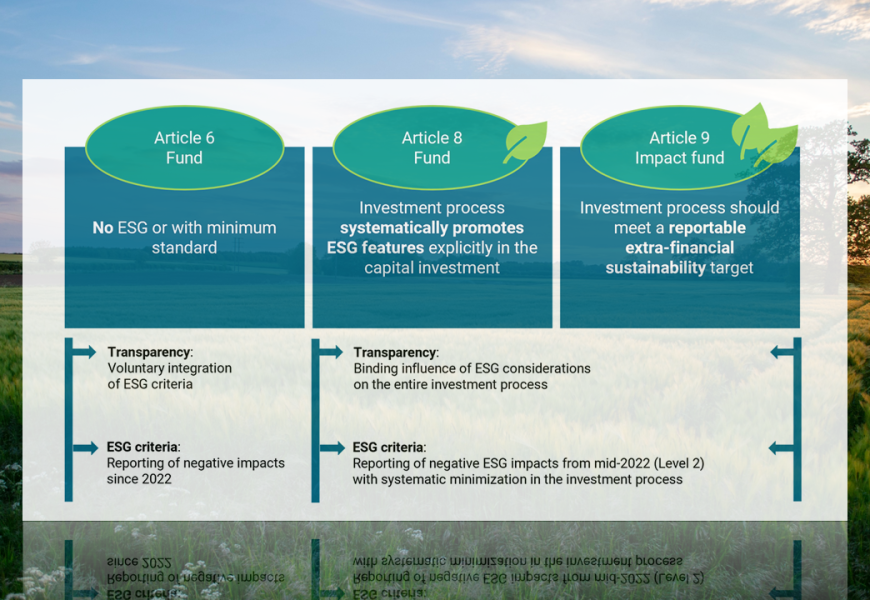

In force since March 2021. Only asset management companies and funds classified under Article 8 or 9 of the EU Disclosure Regulation may be promoted as “sustainable” or have a direct targeted sustainability impact. Attention should also be paid to Article 7 of the SFDR, as from 30 December 2022 at the latest, the adverse impact on sustainability must be disclosed for all products. Planning is currently underway for Level II, the launch of which was recently postponed from July 2022 to January 2023. This will stipulate that asset managers and fund providers must also provide information on the impact of their investment strategy concerning ESG criteria in a reporting document. Asset managers must then maintain so-called qualitative reports on their individual products. In the final stage, scheduled to come into force from March 2023, regular ESG reports on asset managers and individual products must be made available with quantitative information.

This should also make it possible to transparently track the actual sustainability impact of an asset management or a fund investment. However, the specifications for the published details and reporting sizes are currently still being finalized. From mid-2022, however, the SFDR classification should then combine the classification of investment processes with documentation of their impact on the portfolio. In the past, this was only possible individually through ESG seals on the one hand and ESG fund ratings on the other.

EU taxonomy

The EU taxonomy is lagging behind its own claims. Up to now, corresponding sustainable activities and technical criteria have only been defined for two of the taxonomy’s total of six environmental objectives. When the taxonomy is fully published, asset managers will have to verify if their investments are sustainable in the sense of the EU taxonomy. The roadmap for the application of the taxonomy is as follows:

- For climate targets: From 1 January 2022

- For other environmental targets: From 1 January 2023

- For other ESG targets: Thereafter

MiFID II amendment with definition of sustainability preferences from 2 August 2022 onwards.

Official regulations have been in place since 2 August 2021: With the publication of the Delegated Regulation on MiFID II at that time, interviewing investors on their sustainability preferences has been subject to binding new regulations: Due to the many aspects that advisors must inquire about and document accordingly, investors’ sustainability preferences will be very narrowly confined. So confined that the present product classification according to the SFDR alone can hardly verify whether an investment solution is suitable for the preferences ascertained.

In detail, the following criteria for sustainability preferences are envisioned by supervisory law:

- Consideration of adverse effects (PAI): Investors can and should define the extent to which companies working to address the adverse impacts of their operations (Principle Adverse Impacts) on sustainability goals should be considered for sustainable investment.

- Positive contribution to environmental or social goals: According to Article 2, no. 17 of the Disclosure Regulation, investments are to be considered sustainable above all if they contribute to achieving environmental or social goals while avoiding governance violations. Investors should also be able to expect a certain proportion of such investment effects from an investment product if it is declared sustainable.

- Positive contribution to taxonomy: Here, the client should specify a minimum proportion of economic activities at the fund or portfolio level that is taxonomy compliant. The big challenge for the consultancy here is to moderate customers’ expectations:

The problem is that the Taxonomy Regulation does not yet cover many companies’ business activities: Namely, only those that are related (1) to climate change mitigation and (2) to adapting to its consequences. The four other subject areas related to “E” have not yet been conclusively addressed by the taxonomy, let alone “S” and “G”: (3) Sustainable use and protection of water and marine resources, (4) Transition to a circular economy, waste prevention and recycling, (5) Pollution prevention and control, (6) Protection of healthy ecosystems and biodiversity.

Furthermore, companies are not obliged to report on this until 2022. Conversely, for consulting, this means: Comprehensive data for EU companies will not be available until 2023. As a consequence, it will be difficult to measure taxonomy compliance until that time.

BaFin guidelines for sustainable investment funds

Surprisingly for many, BaFin has formulated its own requirements for sustainable investments, some of which are far more stringent than the requirements at EU level. The Federal Financial Spervisory Authority Bafin has currently postponed the introduction of the planned regulations for the classification of investment funds as sustainable for an indefinite period of time.

Recommendations for action

For consulting services, taking into account sustainability factors contained in the MiFID II-related delegated legislation entails a considerable implementation effort and a risk that should not be underestimated. Among other things, it means extensions to investment advisory and portfolio management systems, comprehensive staff training and revised sales strategies. It is, therefore, essential for affected stakeholders to take action at an early stage to prepare adequately for the requirements.

Specifically, it is advisable not only to analyze the existing regulations concerning governance and processes to identify a possible need for adaptation but also to anticipate possible implications for the next technical implementations. This is because, once the SFDR Level II Regulatory Technical Standards (RTS) come into force, fund companies and asset manager will not only have to disclose which of the key negative sustainability impacts (PAIs) of their investments they take into account, but also how they intend to do so and deal with the negative impacts (or justify non-disclosure, if applicable). In addition, they will have to complete comprehensive pre-contractual and periodic disclosure templates or reports, quantitatively and qualitatively, for all funds with environmental and social characteristics (Article 8 funds) and funds with sustainable investment objectives (Article 9 funds).

Torsten Reischmann, Executive Director Product Management Portfolio & Advisory Solutions at Infront

“In the meantime, we have implemented disclosure regulation reports for Article 8 products in particular for our clients and will also provide a standard template as a basis for specific individualisation from mid-May. Due to the lack of clear options for assigning Article 8 products in particular to MIFID sustainability categories, we are currently assuming that we will make adjustments to profiling as well as target market and suitability checks in the first step and then focus on the core regulatory aspects using the German association target market concept. Of course, we will also watch the further interpretations of the associations, such as the VuV and DSGV, and incorporate these into our planned development. We can already support further requirements of individual customers at any time using the individualisation layer of our systems,” says Torsten Reischmann, Executive Director Product Management Portfolio & Advisory Solutions, Infront.