Need for action to reinforce economic security and support net zero – a German-Japanese perspective

Despite the distance of around 9,000 kilometers between Berlin and Tokyo, Germany and Japan are close partners. Both countries are intensifying their bilateral relations and face similar transformation challenges due to their dependence on frictionless global trade and net zero commitments. The Frankfurt Main Finance study presents a three-step approach to managing global supply chain risks.

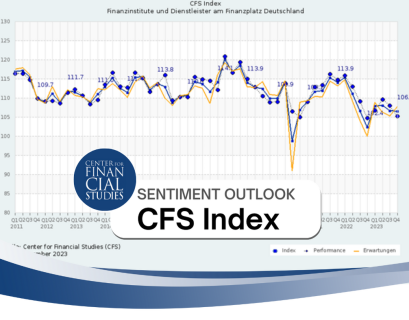

CFS Index remains stable thanks to good results in the last quarter

In the fourth quarter of 2023 at +0.8 points, the CFS Index shows almost unchanged stability in the German financial sector. Despite positive results, expectations for the first quarter of 2024 are significantly more pessimistic, particularly among service providers.

Frankfurt to host the AMLA

The Anti-Money Laundering Authority (AMLA) will be based in Frankfurt am Main. This was decided by the Council and Parliament of the European Union on Thursday (22 February 2024) in Brussels.

Frankfurt economist Philipp Sandner passed away

The financial centre mourns the loss of Prof. Dr Philipp Sandner, an influential character in the German blockchain scene.

Bundesbank calls for networking of players in the financial centre

The financial centre Frankfurt has a special responsibility in financing the transformation of the economy. This is why Bundesbank board member Sabine Mauderer is calling for closer networking between the players.

The Synergies between Japan and Germany

Japan and Germany can shoulder the ecological transformation more easily through increased cooperation, write the President of Frankfurt Main Finance, Gerhard Wiesheu, and the Japanese LDPD member of parliament Seiji Kihara.

3 Questions to Corinna Egerer, Founder and Managing Director of Frankfurt Digital Finance

Corinna Egerer and Max Hunzinger co-founded Frankfurt Digital Finance in 2019. Since then, the conference has developed into one of the leading events in the Frankfurt financial center and does not only have national but also international appeal. We spoke to the founder about the journey there and the upcoming conference.

Frankfurt Goes COP28

In the run-up to the COP28 summit in Dubai, Frankfurt Main Finance asked its members what concrete measures they are taking to actively contribute to climate protection in view of the global challenges posed by climate change.

Delegation from the Montréal financial centre on a working visit to Frankfurt

Representatives of the financial centers Montréal and Frankfurt met in Frankfurt for a working visit and discussed the future of their further cooperation.

CFS survey on “Adherence to the debt brake”

German financial sector considers debt brake necessary – and favours option of easing during crisis periods.